The type of insurance a driver carries will directly impact their options for compensation after a car accident. Different states impose different rules for whether drivers are required to carry auto insurance, as well as what kind of insurance they must carry. In no-fault states, licensed drivers are required to carry no-fault auto insurance. This type of insurance allows you to recover certain losses in the event of a car accident regardless of who was at fault for the collision. No-fault auto insurance was created to reduce the price of insurance by decreasing the number of claims in small claims court.

Compulsory Coverage in No-Fault States

In no-fault states like Massachusetts, no-fault auto insurance is considered compulsory. Massachusetts requires licensed drivers to carry the following four insurance policies:

- At least $20,000 per person, or $40,000 per accident, in Bodily Injury to Others: This policy protects you from liability when you accidentally injure someone while driving your car in the State of Massachusetts. This policy does not cover the injury or death of a passenger in your vehicle.

- At least $8,000 in Personal Injury Protection (PIP): This policy covers medical expenses and up to 75 percent of missed wages, with a maximum coverage limit of $8,000. PIP will cover these expenses for you, anyone you let drive your car, anyone living in your household, passengers in your vehicle, and pedestrians injured in an accident, regardless of who is at fault for the collision.

- At least $20,000 per person, or $40,000 per accident, in Bodily Injury Caused by Uninsured Auto: This policy covers losses you may suffer in an accident caused by an uninsured or unidentified (i.e., “hit and run“) driver.

- At least $5,000 in Damage to Someone Else’s Property: Also known as “Property Damage,” this policy covers damage to another person’s property when you cause accidental damage to another person’s property in an accident.

File an Insurance Claim for Accident Injuries

While many people believe no-fault insurance bars an injured person from suing another driver in the event of a collision, you may be able to sue an at-fault driver for certain losses which are not covered by your no-fault insurance policy if your accident was caused by their negligence. No-fault auto insurance generally does not cover non-economic losses, such as pain and suffering and emotional trauma, resulting from a car accident.

To recover non-economic losses, you may need to file a third-party insurance claim or civil lawsuit against the at-fault driver. However, your injuries may need to meet a certain threshold set by state law for you to qualify for third-party claims and civil lawsuits.

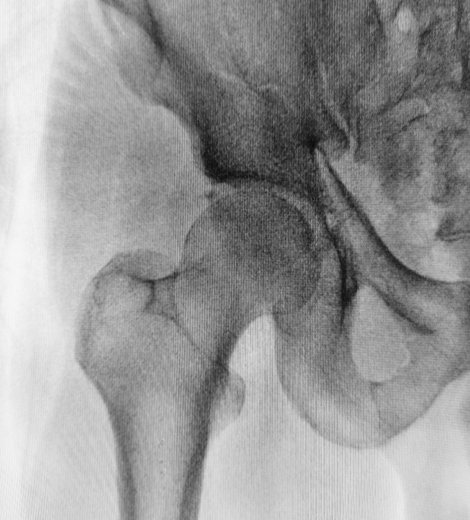

In Massachusetts, for example, you must have incurred at least $2,000 in reasonable medical expenses, and/or your injuries must include:

- Permanent and serious disfigurement,

- Fractured bone(s), or

- Substantial loss of hearing or sight.

If your injuries meet this threshold, you can hold the at-fault driver liable for the accident through a third-party car insurance claim or civil lawsuit and pursue compensation for your pain and suffering and emotional trauma. These claims may be filed in addition to an insurance claim filed through your own policy.

How Can CarAccident.Law Help?

If your injuries meet the threshold set by state law and your accident was caused by another driver’s carelessness, our team of auto collision attorneys can help you file a claim through your own no-fault insurance policy for your medical bills and lost wages, as well as a claim against the at-fault driver and their insurer for your non-economic losses. CarAccident.Law can help you compile medical records and documentation of your missed wages and, if applicable, collect evidence of another driver’s liability for your accident and damages.

No matter which route you take toward compensation, we can help maximize your chances of success. Schedule a case review today to gain our expert legal team’s insight on your situation.

Case Calculator

Evaluate your claim in as little as 30 seconds